What Does Personal Loans Canada Do?

What Does Personal Loans Canada Do?

Blog Article

Personal Loans Canada for Dummies

Table of ContentsPersonal Loans Canada Things To Know Before You BuyThe Facts About Personal Loans Canada UncoveredPersonal Loans Canada for DummiesSome Known Incorrect Statements About Personal Loans Canada The 3-Minute Rule for Personal Loans Canada

Payment terms at a lot of individual funding lenders range between one and seven years. You obtain all of the funds at as soon as and can utilize them for virtually any type of purpose. Borrowers commonly use them to fund a property, such as a vehicle or a boat, pay off financial obligation or assistance cover the price of a major cost, like a wedding or a home remodelling.

Personal fundings included a fixed principal and passion month-to-month settlement for the life of the lending, computed by building up the principal and the rate of interest. A set price gives you the protection of a foreseeable month-to-month settlement, making it a popular selection for settling variable rate credit rating cards. Payment timelines differ for individual finances, but customers are frequently able to select payment terms between one and 7 years.

Our Personal Loans Canada Statements

The charge is normally subtracted from your funds when you finalize your application, lowering the amount of money you pocket. Personal loans rates are more straight connected to short term prices like the prime rate.

You may be used a lower APR for a shorter term, because loan providers know your balance will certainly be repaid much faster. They may bill a higher price for longer terms understanding the longer you have a funding, the more probable something can change in your finances that could make the payment expensive.

An individual car loan is additionally a good alternative to using credit scores cards, considering that you obtain money at a fixed price with a definite benefit day based upon the term you choose. Bear in mind: When the honeymoon mores than, the monthly settlements will certainly be a tip of the cash you spent.

The Best Strategy To Use For Personal Loans Canada

Before handling financial obligation, utilize an individual funding payment calculator to help spending plan. Collecting quotes from numerous lenders can assist you identify the very best offer and possibly conserve you rate of interest. Compare passion prices, charges and lender credibility prior to using for the car loan. Your credit rating is a large variable in determining your qualification for the loan in addition to the rate of interest.

Prior to applying, understand what your rating is so that you know what to expect in regards to expenses. Watch for concealed fees and penalties by checking out the loan provider's conditions web page so you do not wind up with less cash than you need for your monetary objectives.

They're less complicated to certify for than home equity fundings or other guaranteed financings, you still need to reveal the loan provider you have the means to pay the loan back. Individual fundings are better than credit cards if hop over to these guys you desire a set month-to-month repayment and need all of your funds at as soon as.

The Greatest Guide To Personal Loans Canada

Charge card might be better if you need the flexibility to draw money as required, pay it off and re-use it. Credit cards may also offer benefits or cash-back choices that personal financings don't. Ultimately, the most effective credit product for you will certainly depend upon your money habits and what you require the funds for.

Some loan providers might likewise bill costs for personal fundings. Individual lendings are finances that can cover a number of individual expenditures.

As you spend, your offered credit score is reduced. You can then boost offered credit scores by making a payment toward your line of credit. With a personal car loan, there's commonly a set end day by which the car loan will be repaid. An individual line of credit score, on the other hand, might remain open and offered to you forever as long as your account continues to be in good standing with your loan provider - Personal Loans Canada.

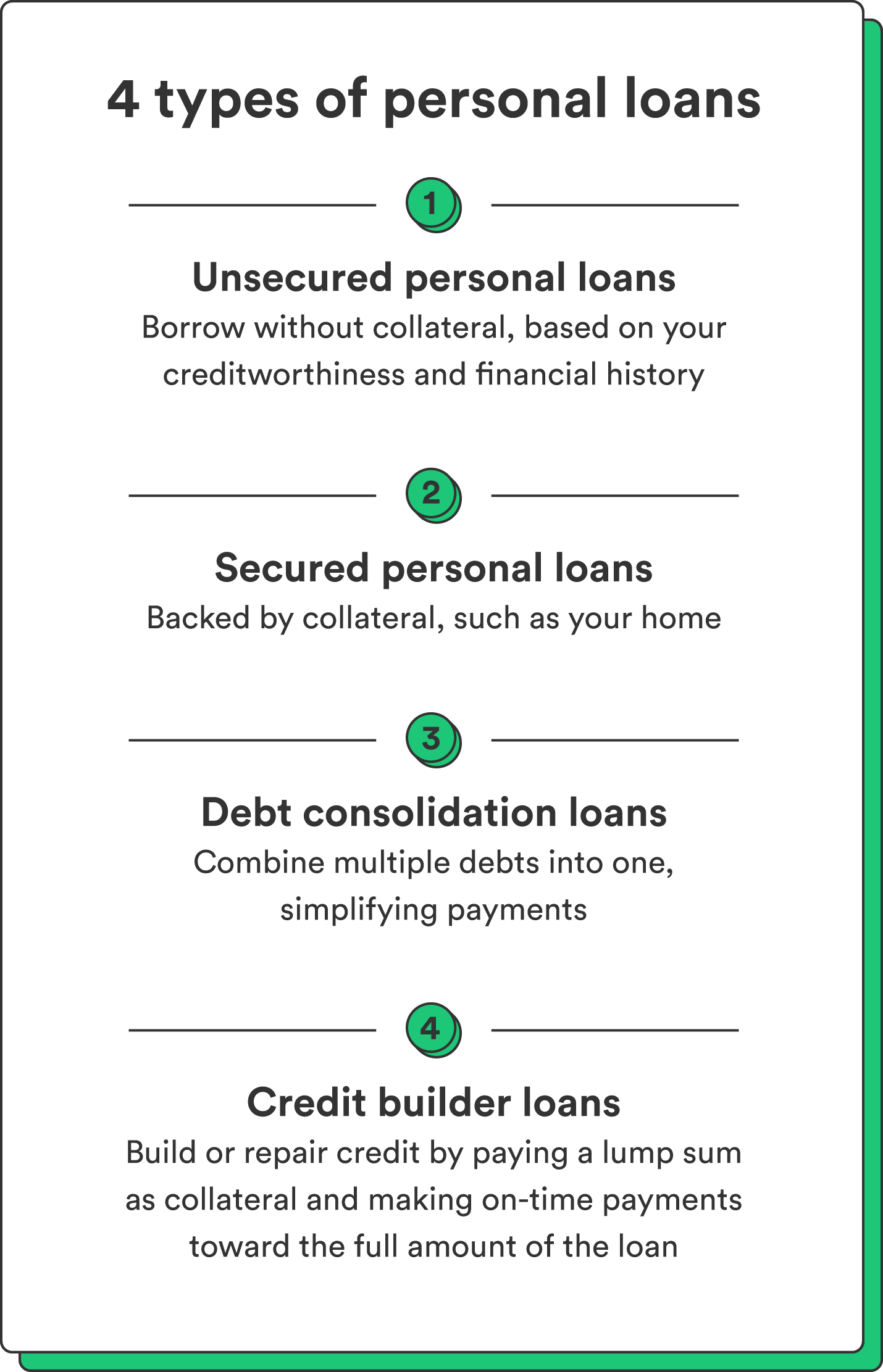

The money received on the car loan is not tired. If the lending institution forgives the lending, it is considered a terminated financial debt, and that quantity can be taxed. A protected individual loan requires some type of security as a condition of loaning.

Some Known Details About Personal Loans Canada

An unsecured individual car loan requires no security to borrow cash. Financial institutions, cooperative credit union, and online loan providers can use both secured and unsecured personal fundings to certified debtors. Financial institutions usually think about the last to browse around here be riskier than the previous since there's no collateral to gather. i thought about this That can suggest paying a higher rates of interest for a personal financing.

Once again, this can be a bank, debt union, or on the internet individual financing lender. Generally, you would first complete an application. The lender examines it and makes a decision whether to approve or reject it. If authorized, you'll be offered the finance terms, which you can accept or turn down. If you concur to them, the next action is completing your funding documentation.

Report this page